"It would be nice if it were straightforward.

Contact the school to find out required fees and expenses so you avoid accidentally taking a non-qualified distribution. Once you start spending money for college, make sure to keep a paper trail. The College Savings Plan Network brings together administrators of 529 plans and is an affiliate of the National Association of State Treasurers.Ībout 12.54 million plan accounts exist nationwide with $253 billion in assets as of December 2015. Young Boozer, state treasurer of Alabama and chair of the College Savings Plan Network, said the advantage of the 529 is that earnings can grow tax-free and, if the money is withdrawn properly, then no taxes are paid on earnings.

529 ELIGIBLE EXPENSES SUPPLIES SOFTWARE

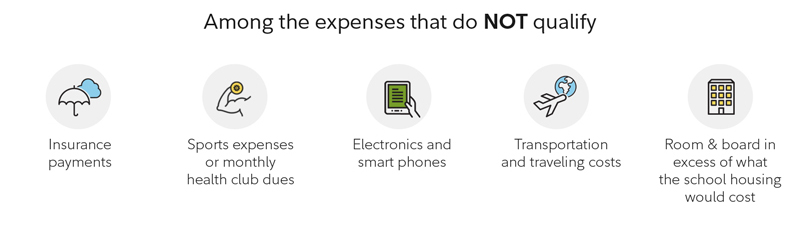

When it comes to computer purchases, computer equipment or software used for gaming or hobbies would not qualify. Bernhardt noted that some special provisions exist for students with special needs. What's not covered? Money spent for sports activities, insurance payments, airline tickets or bus tickets to get to school and back and health club dues. "You're rolling the dice a little bit there," Bernhardt said, noting that the IRS has specific rules on withdrawals. He's heard of some cases where parents keep spending for a few years and then take all the money out of the 529 plan in one lump sum afterwards. Keith Bernhardt, vice president of retirement and college products for Fidelity Investments, said typically you want to take the money out of the 529 plan in the same calendar year as when the qualified higher education expenses occur.

529 ELIGIBLE EXPENSES SUPPLIES HOW TO

Once you save money in a 529 plan, it's essential to study the steps for how to spend money to make sure that your withdrawals from the plan are tax-free. Most times, it would not be considered a qualified expense. The gap year is traditionally a way to allow time for traveling or volunteering.īut if you're buying a computer now and your child is taking a year off, consult a tax professional. Instead of going directly to Harvard University, she will take off one year. What about that gap year? Malia Obama, the oldest daughter of President Barack Obama and first lady Michelle Obama, brought the "gap year" into the headlines. If your child is a sophomore in high school, for example, you wouldn't want to buy that computer now for a birthday or the holidays and then try to withdraw money from a 529 plan to cover that bill. Mark Luscombe, principal analyst of tax and accounting at Wolters Kluwer in Riverwoods, Ill., said the computer must be used primarily by the beneficiary when the student is enrolled at an eligible college, university or educational institution. It's key, though, that you follow the rules if you want to try this strategy. The computer provision also includes some computer software or Internet access. Qualified means that you're not paying taxes on any earnings or facing any penalties when you withdraw that money from a 529 to cover that specific expense. Many parents might not realize it, but Congress passed legislation in late December that made permanent a rule to treat computers and related equipment as a qualified expense in the 529 world. Looking to buy that high school graduate a computer for college? Maybe you can use money in that 529 college savings plan to cover the bill.

0 kommentar(er)

0 kommentar(er)